It is not a stupid question. In 2018, airlines serving the U.S. carried one billion passengers. That is an astounding number of airline miles earned. My bet is, most of those miles will go unredeemed. That is assuming the passenger had a frequent flyer account set up to accrue the miles in the first place. If you are not a miles and points enthusiast, it can be daunting to try to figure out how airline miles work. This post will provide you with a basic understanding that will help you get the most out of your miles.

How do you earn airline miles?

The first part of learning how airline miles work is understanding how to earn them. There is a multitude of ways to earn airline miles, but the two most common methods are through flying and spending on credit cards.

The reality is, unless you fly frequently, you will probably not earn enough miles for an award flight. For example, as a Skymiles member without elite status, you would need to spend at least $3,000 on flights before having 15,000 miles. In the best case, that is the number of miles required for the cheapest domestic roundtrip award tickets. If a 15,000-mile award ticket costs $300, your mileage earning rate of earning miles is roughly equivalent to 10% cashback.

Chances are unless you regularly fly, the best way for you to earn a significant number of miles is through credit card signup bonuses. With that said, there are several other worthwhile ways to earn miles, including shopping portals, dining programs, and links to other loyalty programs. Below, I introduce each of these methods.

Credit cards, signup bonuses, and transfer partners

Credit cards are the quickest and by far the easiest way to earn a lot of miles.

Most U.S. airlines and several international carriers have a co-branded credit card. These cards often have massive signup bonuses that reward you for spending a certain amount within the first few months after your account opening. Each of the “big three” U.S. airlines (United, Delta, and American) have several different versions of their cards. Between the basic, premium, personal, and business versions of these cards, you can easily gin up hundreds of thousands of points.

It is easy to meet the minimum spending requirement on these cards while getting most of your money back in a short amount of time. See my guide to manufactured spending and buying groups for some ideas.

Beyond co-branded credit cards, cards that earn bank points are also great for accruing a large stash of miles. Premium cards from Citi, Amex, and Chase usually come with 50,000 – 100,000 point signup bonuses. These cards are especially useful because they allow you to convert the points you earn with them into airline miles.

As of this writing, Chase has nine airline transfer partners, Amex has six, and Citi and Capital One have fifteen. The quantity of partners is not everything though. Redeeming miles through one airline can be significantly cheaper than through another. As an example, the number of Virgin Atlantic miles required for a Delta flight is often substantially less than Delta would charge you if you use Delta Skymiles. With this flexibility, bank points are generally more valuable than airline miles.

Furthermore, banks will frequently offer a “transfer bonus” whereby you can transfer miles at a higher ratio. The standard transfer ratio for Amex Membership Reward points to British Airways Avios points is 1 to 1. However, Amex frequently increases this ratio to as high as to 1 to 1.5.

In addition to the massive signup bonus, these bank credit cards offer elevated earning rates for spending in select merchant categories. For dining purchases, the Citi Prestige card earns 5 points per dollar, while the Amex Gold card earns 4 points per dollar. See my guide to the best credit cards for dining to learn about the other cards that offer a restaurant category bonus

Earn miles with paid flights

Of course, you also earn miles from paid flights.

You do not earn miles from award flights – that is, flights booked using airline miles or certificates. However, you do earn miles from nearly every other flight, regardless of how you purchase the ticket. For example, when using a Chase Sapphire Reserve card to redeem points for 1.5 cents each through the Chase travel portal, you earn miles. You also earn miles if your employer or someone else paid for your ticket.

When you complete a paid flight, you earn two types of miles: redeemable miles (“miles’) and elite-qualifying miles (“EQMs”).

As the name implies, redeemable miles are those that allow you to book award tickets. Whereas EQMs have no monetary value but will enable you to qualify for elite status if you earn enough of them in a year. EQMs are earned based on the distance of your flight.

Airlines want to recognize those that take frequent short-distance flights as well. Instead of meeting the minimum EQM requirements, most airlines allow you to qualify for elite status after flying a certain number of segments. These are a called Elite Qualifying Segments (“EQSs”).

Regardless of whether you qualify based on EQMs or EQSs, several airlines have added another requirement: Elite Qualifying Dollars (“EQDs”). This metric is based solely on the amount you spend on cash tickets.

Overall, to reach the lowest tier of American, Delta, or United elite status, you need to earn 25,000 EQMs or 30 EQSs, plus $3,000 EQDs.

The exact number of redeemable miles and EQMs you earn from flights depends on the airline you fly and which airline you credit the miles to.

Earning miles from the airline you are flying

The three major U.S. airlines (Delta, United, and American) award miles for their flights, based on the amount you paid for your ticket less taxes. That means you will earn the same from a $400 roundtrip from New York to Boston as you would from a $400 roundtrip from New York to Los Angeles.

Generally, the higher elite status you have with an airline, the more miles you will earn. Non-elite members flying Delta, United, or American, earn 5 miles per dollar spent. Whereas those with top-tier elite status earn 11 miles for every dollar spent.

Other airlines, such as British Airlines, base the number of miles you earn on the distance of your flight and the type of fare you purchase. As we will discuss, this is the same way airlines award miles for flights on partner carriers.

Earn miles from flights on partner airlines

You can also earn miles from one airline by flying with one of its partners. In this scenario, the number of miles you receive depends on how you purchased your ticket.

As an example, assume you are flying on British Airways and want to earn American AAdvantage miles. American and British Airways are both Oneworld alliance members. You can purchase an American and British Airways flights on either AA.com or on BA.com.

If you booked your BA flight ticket through AA.com, you earn the same number of miles you would receive if you were flying American. That is, the amount is based on the price you paid for your ticket. Alternatively, if you book your BA flight on BA.com and add your AAdvantage member number to the reservation, you earn based on a specific American partner award chart.

During the booking process or after your reservation has been ticketed, you can choose which frequent flyer currency you want to earn. When you book a BA flight on BA.com but credit to a different airline, the number of miles earned is determined by the airline program you are crediting miles to.

In most cases, including when you credit to American, the number of miles awarded is based on the distance flown and fare class of your ticket.

Fare Classes

Fare class is not the same as your cabin (economy, business, or first). Instead, within those service classes, there are additional subdivisions. The top-level fare code in the three main cabins (Y, J, and F) is consistent across all airlines and usually referred to as “full-fare.” The other codes are known as “discount” fares. You earn substantially less from a discounted fare class ticket than you would from a full-fare ticket.

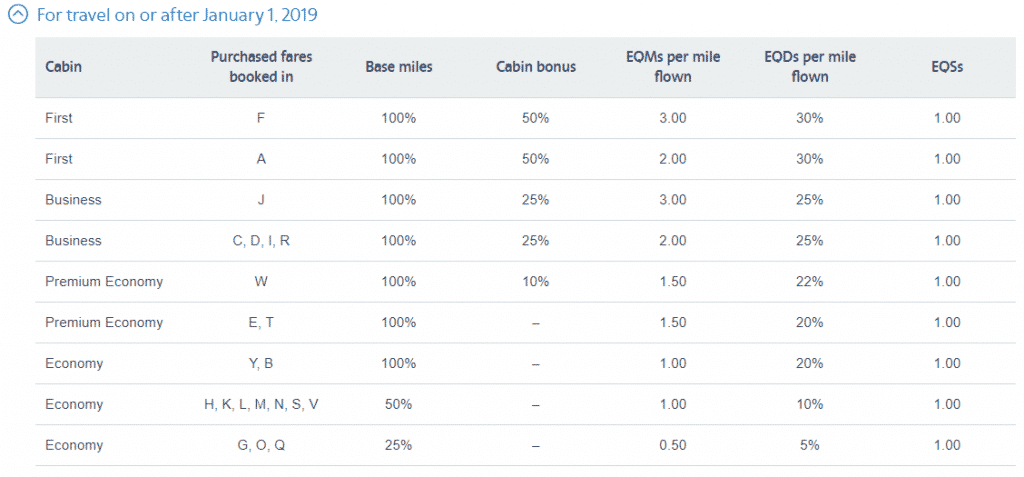

Your fare class dictates the number of miles, EQMs, and EQDs you earn from flights with partner airlines. The chart below shows the number of miles you would earn on the British Airways ticket booked through British Airways and credited to American.

As shown in the chart above, deeply discounted economy tickets earn redeemable miles at a rate of 25% of the distance flown. On the other hand, full-fare economy fares receive 100% of the miles flown, and any ticket in business or first class will earn an additional “cabin bonus.” The amount of EQMs you earn per mile flown is also based on your fare class.

Based on WebFlyer’s MileMarker tool, a flight from New York (JFK) to London Heathrow is 3,440 miles. Therefore, if you book one of the three lowest fare classes (G, O, or Q), you would earn 860 redeemable miles and 1,720 EQMs. Whereas if you booked full-fare Economy (Y or B), you would earn 3,440 redeemable miles and EQMs.

Shopping Portals

There is another way to earn airline miles without flying. Most of the major international airlines, including United, Delta, American, and Southwest, have shopping portals.

Shopping portals reward with miles, points, or cash back for making purchases at retailers when you start at the shopping portal, rather than starting at the retailer. You still pay the same price and continue to earn points or miles from the credit card you use. There is no downside to going through a portal.

You can use Cashbackmonior.com to compare the cash back or points you would earn from different portals with a particular retailer. Occasionally, portals may offer as much as 10-20% cash back or points per dollar at major retailers such as Macy’s, JC Penney, and Overstock.com. Portals will also offer seasonal promotions that reward you with bonus miles for spending a certain amount over a specified period.

These bonuses can be extremely lucrative on their own, let alone if you are spending thousands on purchases for a buying group.

The most famous shopping portal is Rakuten, which was formally known as Ebates. Rakuten allows you to earn cash back or Amex Membership Rewards at hundreds of online retailers. Many portals, including Rakuten, also offer cash back for in-store purchases. For those purchases, link your credit or debit card to Rakuten, opt-in to the specific store or deal, and then use your linked card at checkout.

Dining Programs

Several airlines also have a dining reward program. These operate like in-store rewards with a shopping portal. Sign up for an account, link a credit card, and use that card at a participating restaurant. Admittedly, you may not find it worthwhile to go out of your way to dine a restaurant to earn a few extra miles. However, it makes sense to take a few minutes to link your favorite credit card for dining to one of these programs.

Unfortunately, you can only link a particular card to one program. If you are signing up for multiple programs, you should use different credit cards.

Linking to other loyalty programs

Several of the major airlines have reciprocal partnerships with hotel brands. These partnerships provide you the choice of earning miles with the airline of your choice in place of earning hotel points. For example, within your Marriott account, you can designate United or another airline as your preferred reward currency. Usually, you are better off keeping your earning preference as hotel points, unless you do not believe you will ever redeem them.

Those with elite status with Hyatt or American can benefit from the programs’ partnership to earn reciprocal elite status in the other program. If you link your account and have at least AAdvantage Gold or Hyatt Discoverist status, you will also receive bonus Hyatt points for flying American and bonus American miles for Hyatt stays.

Delta has partnered with Lyft to give you the option to link your accounts and earn 1 mile per dollar spent on Lyft rides and 1 mile for every dollar spent on airport rides. Likewise, if you link your Airbnb account with Delta, you can earn 1 mile per $1 spent on Airbnb stays worldwide. Again, since these miles are in addition to any credit card rewards you earn, there is no downside to linking your accounts.

How do you redeem airline miles?

Obviously, earning is only part of how airline miles work. Once you have enough miles, you want to redeem them for a free flight. That sounds simple enough, right? Well, not exactly.

Each frequent flyer program requires a different number of for-free flights. Some airlines will not even tell you how many miles you need for an award flight until you search for specific dates. Even then, the number of miles required may be different if you check the next day.

Needless to say, redeeming miles gets complicated.

Previously, most airlines charged a fixed price for award tickets based on distance or geographic region. Lately, many of the major airlines have been moving closer to a dynamic pricing system. In that case, the price of the flight in miles is loosely based on the cash price of the ticket. Alternatively, some airlines, such as Southwest, provide a fixed redemption value for their points.

Below we will look at the main redemption models: zone-based, distance-based, cost-based, and dynamic award pricing.

Zone-based Award Charts

Zone-based award pricing means you pay a set number of miles to travel between one geographic region and another. A certain number of tickets are available at a base redemption level, usually known as “Saver” awards. After there is no saver space remaining, airlines will generally offer the remaining seats at a higher redemption level. This non-saver redemption price can be as high as 2-3x the cost of saver awards.

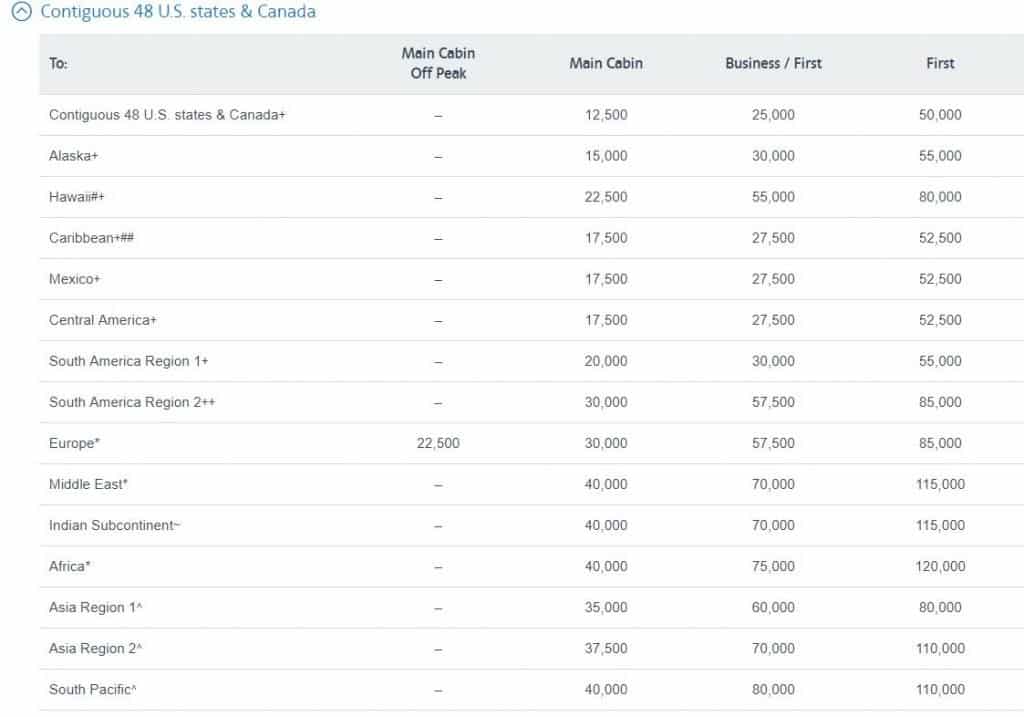

Historically, most airlines have operated using this model. American AAdvantage miles work this way. In fact, among the “big three” airlines, American is the only one that still has zone-based pricing. While most expect American to move toward dynamic pricing soon, for the time being, travelers can often redeem based on the number of miles in the award chart below.

American Airlines classifies award fares for their flights into three buckets: MileSAAver Off-Peak (only applicable to specific routes), MileSAAver (standard pricing, often called “Saver” availability), and AAnytime (everything else).

Unfortunately, American only releases a certain number of tickets eligible for MileSAAver pricing. Once those are gone, the price will increase to an AAnytime-level. While the reward chart shows two levels of AAnytime rewards, the reality is, the cost can skyrocket to virtually anything. It is common to see domestic U.S. main-cabin AAnytime awards at 65,000 miles one-way during peak travel periods.

Distance-Based Award Pricing

Distance-based charts mean the cost of an award price is based on the distance between your origin and destination.

For example, British Airways (BA) miles work this way. The airline pries awards based on distance, as shown in the table below.

Some of the best redemptions with distance-based charts are on short-haul flights that would typically traverse two regions in a zone-based chart. British Airways requires 12.5k points for flights operated by American and Alaska Airlines between the west coast of the U.S. and Hawaii. That compares to 20-22.5k miles if booked directly through American.

Alaska is not a member of the Oneworld alliance but has a partnership with British Airways. Alaska flies to Hawaii from several west coast U.S. cities, including Los Angeles (LAX), Seattle (SEA), San Francisco (SFO), San Diego (SAN), Portland (PDX), and San Jose (SJC).

Cost-Based Award Pricing

Cost-based award pricing means the number of miles or points needed is directly tied to the cash price of the ticket. Usually, these programs allow you to redeem points on any flight with an available seat. Naturally, the cash fare rises as a flight gets closer to being sold out, so you end up needing to use more points.

Among the major U.S. airlines, Southwest Airlines miles work this way. Southwest provides a fixed redemption value per Rapid Rewards point. Whether you book a Wanna Getaway, Anytime, or Business Select fare, your points are always worth exactly 1.28 cents per point toward the base fare. You are still responsible for paying some of the government-imposed taxes and fees associated with the tickets.

JetBlue also has cost-based awards, though the actual value you get can be a bit of a mystery.

Technically, if you have a Delta American Express card, you can also redeem through a cost-based model on Delta. That’s because with the “Pay with Miles” feature you can redeem your miles at a rate of 1 cent per point toward paid tickets on Delta.

Dynamic Award Pricing

On the other hand, Dynamic Award pricing operates somewhere in between cost, distance, and zone-based models. In this model, the number of miles required for an award ticket is loosely tied to the cash price of the ticket.

Delta and United miles work this way. In the past decade, the two airlines have moved from zone-based award chart to dynamic award pricing models. While you still find there are typical minimum redemption levels for flights between two cities, both airlines have stopped publishing their award chart.

The move to dynamic pricing may not be all bad news. It is possible that some flights, particularly those that would have priced at an “Everyday” award level, are cheaper.

Redeeming for travel on partner airlines

Most major airlines are a member of an alliance: Skyteam, Oneworld, and Star. In the U.S., Delta is a member of Skyteam, United is a part of Star Alliance, and American is a member of Oneworld.

Alliances provide you with more options to use miles. That is because you can redeem miles you have with one member of the alliance for flights on another. These are called partner awards. For example, one of the best uses of American Airlines miles is to redeem for travel on Cathay Pacific.

While many major airlines are moving toward dynamic award pricing, partner awards offer a reprieve. Redeeming miles for partner awards works like a zone-based award chart. The chart below shows American’s award chart for redemptions on partner airlines.

The challenge with partner awards is availability. Similar to “Saver” availability, airlines only make a certain number of award seats in each cabin available for partner redemptions. Most open their booking schedules between 330 and 360 days before departure. Therefore, the best time to book an award trip is about a year before departure.

The most sought-after rewards are international flights in either business or first class. With those, it is common for all award tickets to sell out in the first days after becoming available. Sometimes though, airlines will release additional unsold seats in the days or weeks leading up to departure. Lufthansa is known for releasing additional first and business class seats around anywhere from two weeks to one day before departure.

Nowadays, most partner availability can be searched and booked directly through the website of the airline you are redeeming miles through. For example, American allows you to book award travel on Qatar, Etihad, British Airways, and a dozen other airlines directly on AA.com. Unfortunately, for several other AA partner redemptions, including Cathay Pacific, you still need to call in to book.

Redeeming miles for other items

Some airlines offer other redemptions options, such as event tickets and experiences. Delta’s Skymiles Experiences and United’s MileagePlus Exclusives allow members to bid on access to exclusive concerts, sports, dining, and travel events with their miles.

American has a travel portal that lets AAdvantage use their miles to book hotels and car rentals. A minimum of 1,000 miles is required for each transaction, but members can combine miles and cash to pay for the rest of the booking. Most of the hotel options offer slightly lower than one cent per mile of value. Although, AA promotes “exclusive deals” on select hotels for AA co-branded credit card holders and those with elite status. These deals seem to bring the redemption value closer to 1 cent or more per mile.

Generally, these offer a poor redemption value compared to flights. However, if you have a large stash of miles, these can make sense to consider.

The value of miles

Airline miles work like any currency. The value of miles rises and falls based on the redemption options available and how easy they are to acquire. Through co-branded credit cards and changes in earning structures, airlines control the number of miles in circulation. Airlines also periodically change their award redemption charts. Nine times out of ten, these changes result in increased award prices.

There is no debating that over the past decade, the value of airline miles has declined. While it is still relatively easy to acquire miles through credit cards, it is harder to redeem them for a good value.

Generally, though, you should strive to redeem for a minimum of 1 to 1.4 cents of value per mile. If you redeem for business or first-class international tickets, you can expect to receive a lot more value. For example, a roundtrip business class ticket from the U.S. to Asia costs about $6,000 to $9,000. On the other hand, the average miles required is about 150,000.

With that said, the value of your miles is subjective.

In some cases, what you compare is cut and dry. You know you want to take a specific flight and fly in a particular cabin, and you know how much that would cost. You are willing to pay for it either with cash or miles.

However, in other cases, it is not so clear. There may never be a scenario in which you would be willing to pay $6,000 for a business-class ticket. If you are only willing to pay $1,000 for an economy ticket, then that is what you should compare to your award redemption.

The most important thing is to understand how airline miles work and have a plan to use them. It makes little sense to sign up for the Southwest credit card if you do not live in a city that is served by Southwest. If you have a destination in mind, you can be strategic about earning the right miles to get you there.

Likewise, there is no point in hoarding miles. There will always be another credit card to sign up for, another portal promotion, or another manufactured spending opportunity.

It is clear you’ve committed a great deal of time to this blog. I’ve tried to locate your first post to identify your projections for the blog, however, the posts do not seem to align chronologically on the pages. Therefore, I will ask- what is your goal with the site? Do you have a unique background or perspective on the hobby? Looking forward to your next posts.